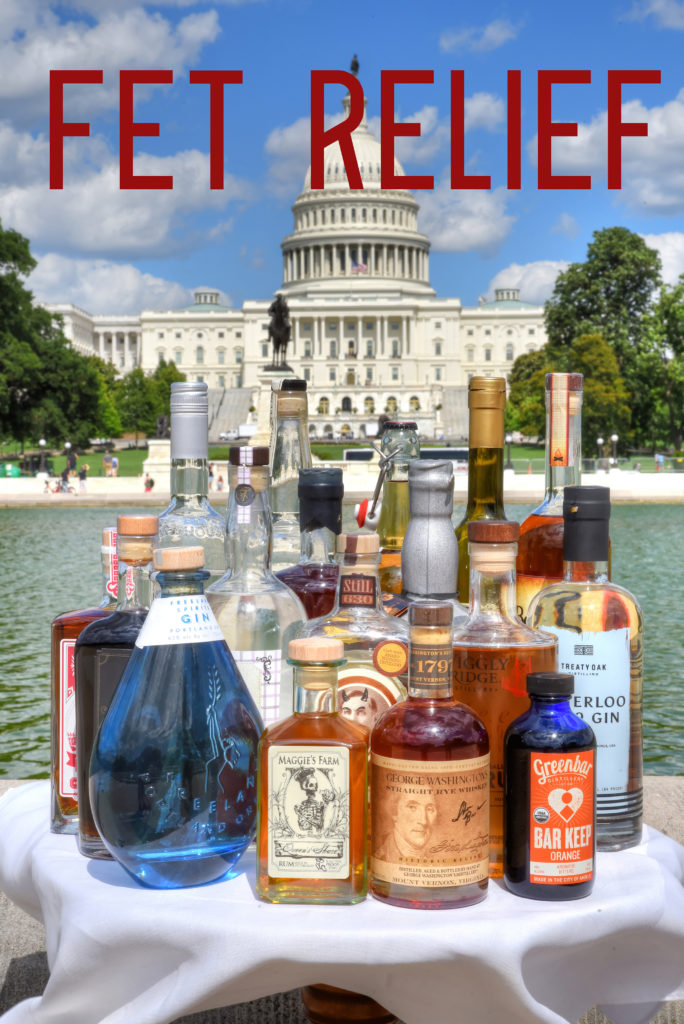

December 20, 2019 (Washington) – Following approvals in the U.S. House and Senate, today the President signed the Craft Modernization and Tax Reform Act (CMBTRA) as part of a larger tax package, which will give the country’s 2,000 craft spirits producers much-needed tax relief and parity with their counterparts in beer and wine, who have enjoyed a lower tax rate for many years. FET reform has been ACSA’s top legislative priority, and its extension passage today marks a major victory for the distilled spirits industry, who faced a 400 percent tax hike come January 1, 2020 without legislation.

Prior to today’s passage, the American Craft Spirits Association, together with other major beverage industry groups, worked tirelessly to rally support for FET relief, which was set to revert back to $13.50 from $2.70 for the first 100,000 proof gallons removed from bond per year. CMBTRA had also garnered tremendous bipartisan support with endorsement by more than three-fourths of the House and Senate. Though industry groups had advocated for permanent passage, this one-year extension still provides significant continued relief. Come early 2020, ASCA, along with its industry allies in beer, wine and cider will once again begin a broader push for permanence.

Since 2015, craft spirits producers across the U.S. have rallied together in an effort to push forward long-term FET relief, and although today’s victory is a temporary one, it is clear this grassroots storytelling effort is working. ACSA has facilitated more than 1,000 meetings with Members of Congress and their staffers. This past year, ACSA brought more than 150 craft spirits producers and the entire Board of Directors and Past Presidents to the Hill to share their stories. PAC chair Steve Johnson of Vermont Spirits Distilling Co. also managed ACSA’s advocacy efforts, promoting the clear connection between FET relief and job and agricultural growth. Member PAC contributions were paramount to the success of this reform extension, but these efforts will need additional attention in 2020 to keep up the dialogue.

Margie A.S. Lehrman, CEO, ACSA: “In a political climate that is arguably more divided than ever, we applaud Congress for working together on both sides of the aisle to support our community of 2,000 small businesses and do what is vitally important to keep our industry growing. Though FET permanence is critical to the long-term success of our industry and the peripheral industries we support, including U.S. agriculture and hospitality, today we celebrate a small but critical victory. But tomorrow, we will again shift gears to focus on permanent tax relief and long-term parity with our friends in craft beer and wine.”

Chris Montana, President, ACSA and Co-Owner, Du Nord Craft Spirits: “As President of ACSA and a craft spirits producer myself, I know firsthand the struggles we all face in forecasting our financial futures. This one year extension is a certain step in the right direction, but the need for permanent reform is evident as ever. Without the certainty of a longer-term reduction, it remains difficult to plan for growth and expand.”

Mark Shilling, ACSA Immediate Past President and Chair, Government Affairs, and Founder, Shilling/Crafted: “Although FET relief through 2020 is a great step forward, there is much work yet to do. A one year extension temporarily saves jobs and keeps businesses afloat, but also continues the cycle of uncertainty and this uncertainty means owners cannot plan and manage into the future, and potential investors will be anxious about additional investments into the industry.”

ABOUT ACSA

The American Craft Spirits Association is the only national registered non-profit trade association representing the U.S. craft spirits industry. Its mission is to elevate and advocate for the community of craft spirits producers, and membership in ACSA is open to anyone.

ACSA is governed by a Board of Directors elected by the eligible voting members of the Association. Voting members must be independent, licensed distillers (DSPs) annually removing fewer than 750,000 proof gallons from bond (the amount on which a Federal Excise Tax is paid.) For information about ACSA, call 202-669-3661.